AI for SME Manufacturing: How Small Producers Are Becoming Smart Factories

Reinventing Carbon Markets with AI: A JW Infotech Perspective on Carbon Reduction Innovation

October 8, 2025

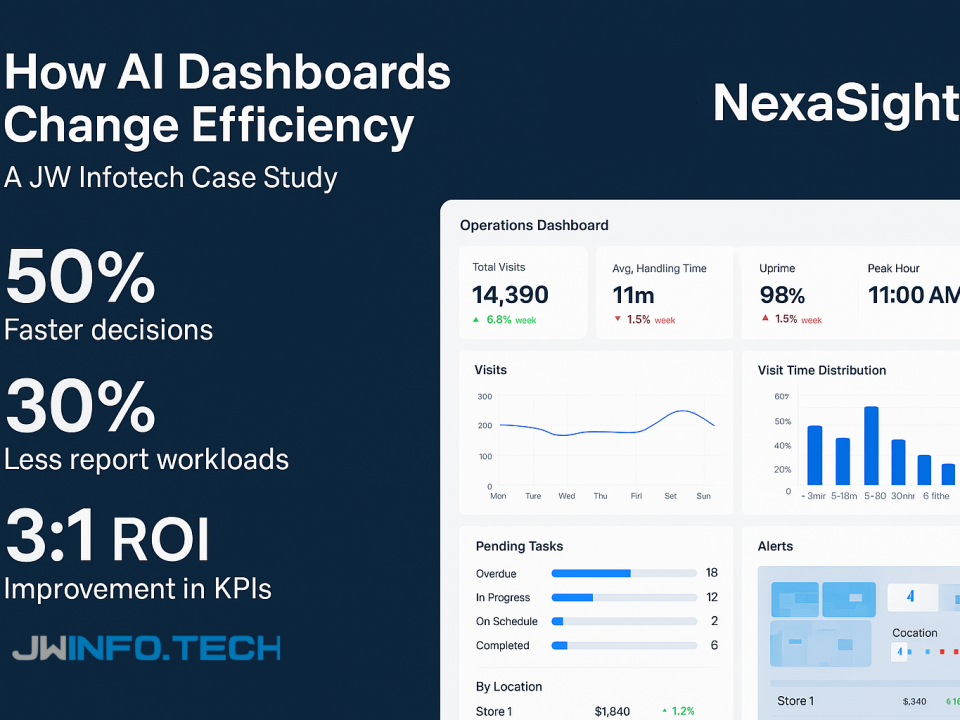

NexaSight Vision Analytics Dashboard for Senior Living Facilities (US)

October 22, 2025SME manufacturers often operate on thin margins with legacy equipment and limited digital skills. AI solutions — when scoped for SMEs — unlock meaningful gains: reduced unplanned downtime, lower scrap/waste, smarter inventory decisions and improved product quality. This study presents a practical JW Infotech approach (roles, tech stack, pilot → scale roadmap) and expected KPIs for SME adopters.

Why now? — market & evidence

• Industry momentum: Industry 4.0 investments continue strong growth, expanding opportunities and lowering per-unit costs for automation and AI components.

• SME digitalization trend: surveys show SMEs are increasingly adopting digital tools to manage shocks and grow; targeted AI use cases now offer rapid ROI when implemented pragmatically.

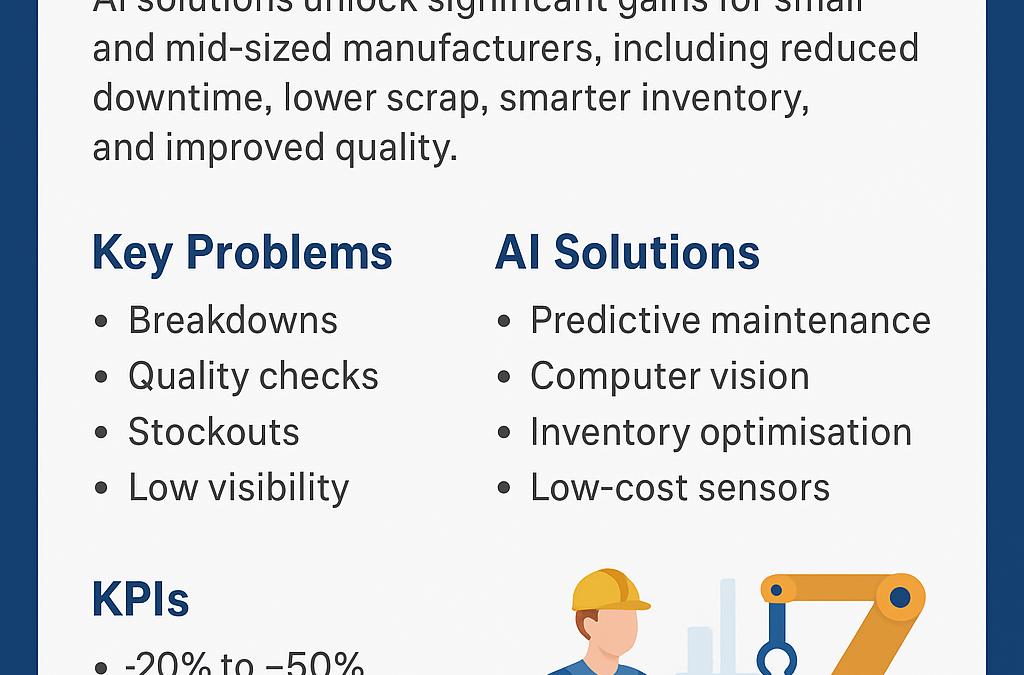

Key SME problems addressed

- Unexpected machine breakdowns and high maintenance cost (reactive maintenance).

- Manual quality checks that create bottlenecks and inconsistent quality.

- Overstock or stockouts due to poor demand visibility.

- Low visibility into process KPIs and energy usage.

JW Infotech solution overview (SME-first)

- Sensor + Edge Tier (low-cost retrofit) — vibration, motor current, temperature, basic vision cameras; edge preprocessing to minimize bandwidth and costs.

- Predictive Maintenance (PdM) — small ML models (anomaly detection + time-to-failure estimators) tailored to asset criticality. PdM reduces surprise breakdowns and schedules maintenance at optimal windows.

- Computer Vision for QA — camera + lightweight models for defect detection (packaging, labeling, surface defects). This reduces manual inspection time and improves consistency.

- AI Inventory & Demand Forecasting — hybrid forecasting (statistical + ML) fused with production schedules and shelf-life to set dynamic reorder points and reduce waste.

- Dashboard + Alerts + Integrations — simple role-based UI, ERP integration for orders and invoices, and mobile alerts for shopfloor teams.

- Pay-for-Outcome commercial model — lower capex barrier via subscription + small hardware fee or outcome-linked pricing.

Multi-role perspective (who does what)

- Plant Manager — approves pilot lines, validates alerts, leads change management on shopfloor.

- Operations Analyst / QA Lead — uses CV insights and dashboards to reduce defect rate and rework.

- Data Engineer / ML Lead (JW Infotech) — implements data pipelines, ensures model retraining and drift detection.

- Procurement / Supply Lead — acts on inventory recommendations and dynamic reorder points.

- CFO / Finance — monitors cost vs savings and signs off on performance-linked payments.

- Local Champion (shopfloor operator) — essential for adoption: verifies sensor mounting, labels events, and provides feedback loops.

Implementation roadmap (practical & time-boxed)

Phase 0: Discovery (1–2 weeks) — asset criticality map, data availability, baseline KPIs.

Phase 1: Pilot (6–8 weeks) — one critical line: install sensors, run PdM models, one CV QA point, and inventory forecast for 10–20 SKUs. Measure baseline vs pilot.

Phase 2: Scale (3–6 months) — roll to other lines, integrate with ERP, and automate maintenance workflows.

Phase 3: Optimize (ongoing) — model tuning, expand use-cases (energy optimization, scheduling, operator assistance).

Expected outcomes & KPIs (benchmarks SME-sized)

- Unplanned downtime: −20% to −50% (depending on baseline).

- Defect rate / rework: −10% to −40% using CV + automated checks.

- Inventory carrying cost / spoilage: −10% to −30% with AI forecasting and dynamic reorder logic.

- Throughput / OEE uplift: single-digit to low-double digit % improvements as process stabilises.

- Payback period: often 6–18 months for well-scoped pilots (SME-centred pricing lowers up-front barrier). (Derived from aggregated SME digitalisation findings.)

Real-world signal (compact examples)

• Large manufacturers report meaningful PdM gains, demonstrating the underlying technology works at scale and trickles down economically to SMEs.

• SME-level smart factory examples (food industry smart-factory rollouts) highlight that family-run and mid-market firms can adopt robotics + AI with government grants or phased investment.

Risks & mitigations

- Data sparsity / noisy sensors → start with the highest-value assets, use expert rules, and progressively collect labeled events.

- Change resistance → recruit local champions, run short training sprints, and instrument visible quick wins.

- Cyber & vendor lock-in → edge processing, open standards (OPC-UA), contractual data portability clauses.

- Model drift → scheduled retraining, human-in-the-loop validation, explainability dashboards.

Recommendations (SME playbook)

- Pick one high-impact pilot (90/10 rule: 10% of assets cause 90% of downtime).

- Use low-cost edge devices and hybrid cloud to control costs.

- Measure from day-one (OEE, MTTR, defect rate, inventory days).

- Adopt a phased commercial model — subscription + outcome bonus to align incentives.

- Scale only after operational adoption — tech without people adoption fails more often than underpowered models.

Closing takeaway

AI is no longer a luxury for large enterprises. With pragmatic design (edge-first, modular ML, human-in-the-loop), SMEs can convert legacy lines into smarter, lower-cost, and higher-quality operations. The right pilot — focused on PdM + one QA or inventory use-case — typically unlocks enough value to drive broader transformation.